Finding an answer to the question which electronic currency is the most profitable to mine is quite difficult. The fact is that the cryptocurrency market has only been formed in recent years. It is constantly changing, in addition, new types of virtual money regularly appear. All this makes a more or less accurate prediction of further developments in the market extremely unlikely.

Nevertheless, every year it becomes more and more difficult for single miners to make a profit by “mining” the most popular cryptocurrencies, such as bitcoins or ether. Therefore, it makes some sense to pay attention to less popular types of virtual currency.

Mining Prospects

It’s important to understand that as virtual money grows in popularity, it becomes more problematic to make a profit from mining. This is due not only to an increase in the number of participants, but also to the arrival of significant financial resources in this segment of the market. As a result, mining individually is simply becoming unprofitable and unprofitable.

Another potential danger is the fact that some recently emerged cryptocurrencies do not provide for the possibility of mining. For example, Ripple or IOTA are among such virtual currencies, showing a steady growth in recent years.

How much can I earn?

It is almost impossible to give an unambiguous answer to the question about potential earnings from mining. This is explained by the fact that it is determined taking into account a lot of difficult to predict factors, including the current rate of a particular cryptocurrency and the dynamics of its change, the amount of investment in mining, the number of participants in the “mining” process, etc.

One should understand the following: the growth of the overall capitalization of the virtual money market leads to a constantly increasing average payback period of the investment. For example, not so long ago, investments in bitcoin mining were returned within 2-3 months, bringing further profit, and the entry threshold was quite low. Today, in order to start effectively mining the most popular cryptocurrency, a serious amount of money is required, amounting to at least several thousand dollars. In this case, the payback period is 9-12 months, and in some cases even more.

Is it possible to mine without investment?

Nowadays, it is quite difficult to talk about serious mining without investments. However, many companies providing cloud mining services are trying to increase the number of customers through a variety of advertising campaigns. In some cases, users are offered an opportunity to “mine” cryptocurrency for free for a certain period of time.

There are also so-called cryptocurrency cranes, which are advertising sites that offer satoshi, i.e. a small portion of bitcoin, as a reward for visiting them. This way of earning cryptocurrency is hardly a full-fledged mining, nevertheless, the number of such resources increases every year, which shows their demand in the market.

Investment risks

The cryptocurrency market is one of the most unstable. Even bitcoin, the value of which has grown tremendously, has fallen in price many times. There is no guarantee that it will pick up again after another crash, which could happen at any time.

Possible problems and pitfalls

The main potential problems of any cryptocurrency are two factors. First, the unclear legal status, which in addition varies from country to country. In today’s global financial market, this is a serious obstacle to further growth.

Second, the main condition for the popularity of cryptocurrency is trust in it. This criterion is hardly stable and objective. Therefore, any problems that arise can easily bring down even the most promoted cryptocurrency.

Energy Inefficiency

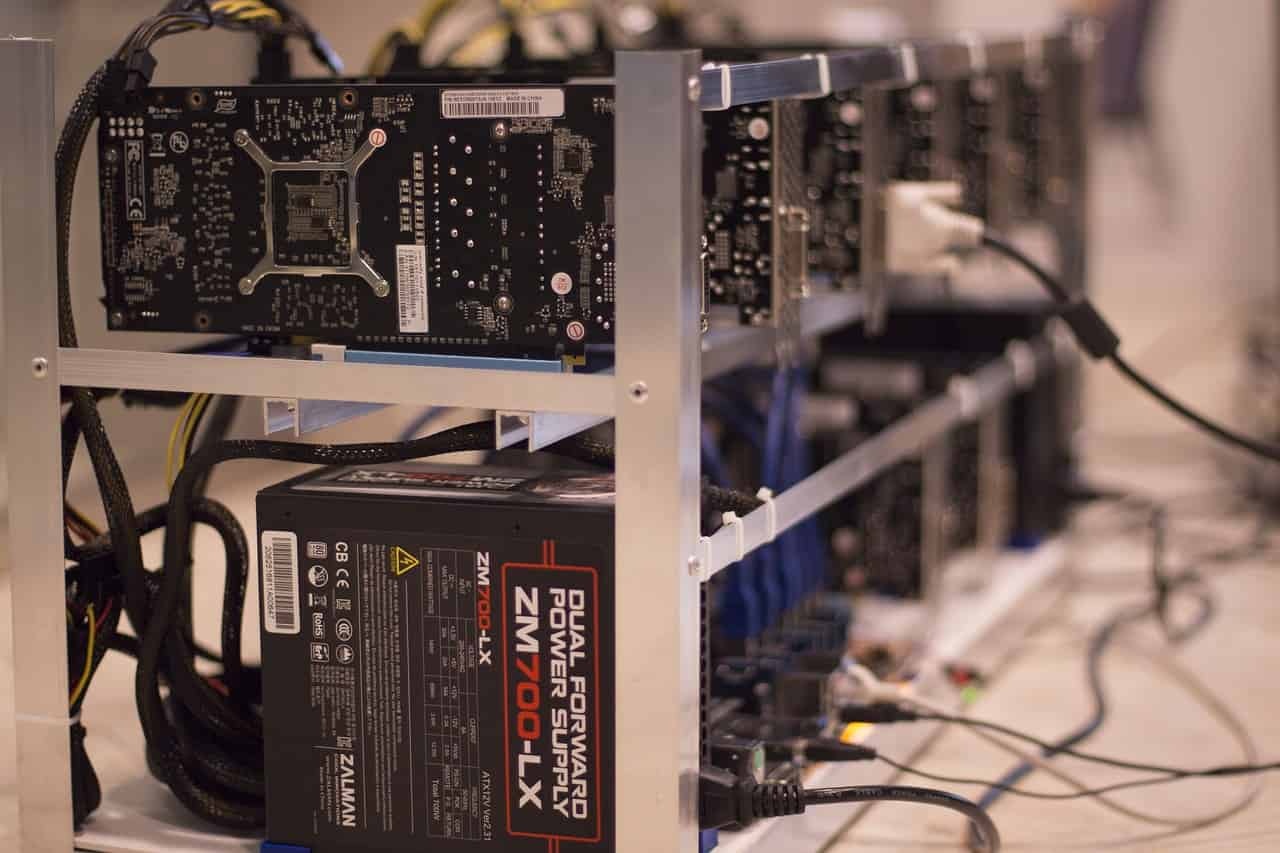

The arrival of major players with serious financial resources to the cryptocurrency mining market has drastically reduced the efficiency of “mining” most types of virtual money. Naturally, the profits made in the process often do not recoup the funds invested, including electricity costs, which constitute the main share of costs, in addition to the purchase of equipment.

The disparity between early and late miners

Every year, the rewards for mining are decreasing. This is due to a very rapid increase in the total computing power of the participants in the process, resulting in a noticeable increase in the amount of resources spent on “mining”, which is torn between electricity consumption and hardware capacity. It makes sense that early mining was much more efficient and profitable than late mining, a trend that continues even now.

What cryptocurrency to choose for mining?

Finding an answer to the question which electronic currency is the most profitable to mine is quite difficult. The fact is that the cryptocurrency market has only been formed in recent years. It is constantly changing, in addition, new types of virtual money regularly appear. All this makes a more or less accurate prediction of further developments in the market extremely unlikely.

Nevertheless, every year it becomes more and more difficult for single miners to make a profit by “mining” the most popular cryptocurrencies, such as bitcoins or ether. Therefore, it makes some sense to pay attention to less popular types of virtual currency.

Mining Prospects

It’s important to understand that as virtual money grows in popularity, it becomes more problematic to make a profit from mining. This is due not only to an increase in the number of participants, but also to the arrival of significant financial resources in this segment of the market. As a result, mining individually is simply becoming unprofitable and unprofitable.

Another potential danger is the fact that some recently emerged cryptocurrencies do not provide for the possibility of mining. For example, Ripple or IOTA are among such virtual currencies, showing a steady growth in recent years.

How much can I earn?

It is almost impossible to give an unambiguous answer to the question about potential earnings from mining. This is explained by the fact that it is determined taking into account a lot of difficult to predict factors, including the current rate of a particular cryptocurrency and the dynamics of its change, the amount of investment in mining, the number of participants in the “mining” process, etc.

One should understand the following: the growth of the overall capitalization of the virtual money market leads to a constantly increasing average payback period of the investment. For example, not so long ago, investments in bitcoin mining were returned within 2-3 months, bringing further profit, and the entry threshold was quite low. Today, in order to start effectively mining the most popular cryptocurrency, a serious amount of money is required, amounting to at least several thousand dollars. In this case, the payback period is 9-12 months, and in some cases even more.

Is it possible to mine without investment?

Nowadays, it is quite difficult to talk about serious mining without investments. However, many companies providing cloud mining services are trying to increase the number of customers through a variety of advertising campaigns. In some cases, users are offered an opportunity to “mine” cryptocurrency for free for a certain period of time.

There are also so-called cryptocurrency cranes, which are advertising sites that offer satoshi, i.e. a small portion of bitcoin, as a reward for visiting them. This way of earning cryptocurrency is hardly a full-fledged mining, nevertheless, the number of such resources increases every year, which shows their demand in the market.

Investment risks

The cryptocurrency market is one of the most unstable. Even bitcoin, the value of which has grown tremendously, has fallen in price many times. There is no guarantee that it will pick up again after another crash, which could happen at any time.

Possible problems and pitfalls

The main potential problems of any cryptocurrency are two factors. First, the unclear legal status, which in addition varies from country to country. In today’s global financial market, this is a serious obstacle to further growth.

Second, the main condition for the popularity of cryptocurrency is trust in it. This criterion is hardly stable and objective. Therefore, any problems that arise can easily bring down even the most promoted cryptocurrency.

Energy Inefficiency

The arrival of major players with serious financial resources to the cryptocurrency mining market has drastically reduced the efficiency of “mining” most types of virtual money. Naturally, the profits made in the process often do not recoup the funds invested, including electricity costs, which constitute the main share of costs, in addition to the purchase of equipment.

The disparity between early and late miners

Every year, the rewards for mining are decreasing. This is due to a very rapid increase in the total computing power of the participants in the process, resulting in a noticeable increase in the amount of resources spent on “mining”, which is torn between electricity consumption and hardware capacity. It makes sense that early mining was much more efficient and profitable than late mining, a trend that continues even now.